Life Insurance for New Immigrants: A Comprehensive Guide

As a new immigrant, navigating the complexities of life in a foreign country can be overwhelming. One important aspect that should not be overlooked is securing life insurance. While it may not be something you immediately think about when starting a new life abroad, life insurance provides financial protection for you and your loved ones in the event of unforeseen circumstances.

In this comprehensive guide, we will delve into the various aspects of life insurance for new immigrants, providing you with the information you need to make an informed decision. From understanding the importance of life insurance to exploring different types of policies, we will cover it all. So, let's get started and ensure your peace of mind in your new home.

Why is Life Insurance Important for New Immigrants?

Starting a new life in a foreign country often entails significant financial obligations and responsibilities. As a new immigrant, you may have dependents, such as a spouse or children, who rely on your income. Life insurance ensures that in the unfortunate event of your untimely death, your loved ones are not burdened with financial hardships.

Life insurance provides a lump sum payment, known as the death benefit, to your beneficiaries upon your passing. This financial support can help cover funeral expenses, outstanding debts, mortgage payments, and other day-to-day living expenses. By having life insurance, you can have peace of mind knowing that your family's financial well-being is protected, even if you are no longer there to provide for them.

Furthermore, as a new immigrant, you may not have an established credit history or assets in your new country. Life insurance can serve as a valuable asset that can be used to secure loans or provide collateral, if needed. It can also help cover any outstanding financial obligations, such as student loans or credit card debt, ensuring that your loved ones are not burdened with these responsibilities.

Understanding the Basics of Life Insurance

Before diving into the specifics of life insurance for new immigrants, it's essential to have a clear understanding of the basics. Life insurance is a contract between you, the policyholder, and an insurance company. In exchange for regular premium payments, the insurance company provides a payout to your designated beneficiaries upon your death.

Key Terms in Life Insurance

When exploring life insurance options, you may come across various terms that are important to understand:

- Premium: The amount you pay to the insurance company for coverage.

- Policyholder: The person who owns the life insurance policy.

- Beneficiary: The person or entity who receives the death benefit upon the policyholder's passing.

- Death Benefit: The lump sum payment provided by the insurance company to the beneficiaries.

- Coverage Amount: The total amount of money that the insurance policy will pay out in the event of the policyholder's death.

- Term: The length of time the life insurance policy is in effect.

- Premium Payment Term: The length of time during which premium payments are required.

- Underwriting: The process by which an insurance company assesses an individual's risk profile and determines their insurability.

Understanding these key terms will help you navigate the complexities of life insurance and make well-informed decisions.

Factors Affecting Life Insurance Premiums

When you apply for life insurance, the insurance company assesses your risk profile to determine the premium amount you will pay. Several factors influence the premium, including:

- Age: Generally, the younger you are when you purchase life insurance, the lower your premiums will be.

- Health: Your overall health, including any pre-existing medical conditions, can impact your premiums.

- Lifestyle Habits: Factors such as smoking, excessive alcohol consumption, or engaging in high-risk activities can result in higher premiums.

- Occupation: Certain occupations that involve higher risks may lead to increased premiums.

- Family Medical History: If you have a family history of certain medical conditions, it may affect your premiums.

- Policy Type and Coverage Amount: The type of life insurance policy you choose and the coverage amount will also impact your premiums.

It's important to note that as a new immigrant, some insurance companies may consider your immigration status as a factor when determining your premiums. This will be further explored in the section on immigration status.

Types of Life Insurance Policies

Life insurance policies can generally be categorized into three main types: term life insurance, whole life insurance, and universal life insurance. Each type offers unique features and benefits, catering to different individual needs and preferences.

Term Life Insurance

Term life insurance provides coverage for a specified term, usually ranging from 10 to 30 years. If the policyholder passes away during the term, the beneficiaries receive the death benefit. However, if the policyholder survives the term, the policy expires, and there is no payout.

Term life insurance is often more affordable compared to other types of policies. It is suitable for individuals who have specific financial obligations to cover within a certain timeframe, such as paying off a mortgage or providing for children until they become financially independent.

It's important to note that term life insurance premiums may increase when renewing the policy after the initial term, as the policyholder is older and may have experienced changes in health or lifestyle.

Whole Life Insurance

Whole life insurance provides coverage for the entire lifetime of the policyholder, as long as premiums are paid. It not only offers a death benefit but also includes a cash value component that grows over time.

When you pay premiums for a whole life insurance policy, a portion of the premium goes toward the cost of insurance, while the remainder is invested by the insurance company. This investment component accumulates cash value, which can be accessed by the policyholder during their lifetime.

Whole life insurance policies generally have higher premiums compared to term life insurance. They are suitable for individuals who want lifelong coverage and are interested in building cash value over time.

Universal Life Insurance

Universal life insurance combines the death benefit of traditional life insurance with a flexible savings component. It offers more flexibility in premium payments and death benefit amounts compared to whole life insurance.

With universal life insurance, you have the ability to adjust your premium payment amounts and frequency, as long as there is enough cash value in the policy to cover the insurance costs. You can also choose to increase or decrease the death benefit amount, depending on your changing needs.

Universal life insurance policies offer more control and flexibility but require active management to ensure the policy remains adequately funded. They are suitable for individuals who want the ability to adjust their premiums and death benefits according to their changing financial circumstances.

Factors to Consider When Choosing a Life Insurance Policy

Choosing the right life insurance policy involves evaluating your personal circumstances and financial goals. Consider the following factors to make an informed decision:

Coverage Amount

The coverage amount, also known as the death benefit, is the amount of money that will be paid out to your beneficiaries upon your passing. It should be sufficient to cover outstanding debts, funeral expenses, and provide for your loved ones' financial needs.

When determining the coverage amount, consider factors such as your outstanding debts, mortgage or rent payments, education expenses for your children, and the ongoing living expenses of your dependents.

It's important to regularly reassess your coverage amount as your financial circumstances change. As a new immigrant, you may experience changes in income, expenses, or family size, which can impact the appropriate coverage amount.

Policy Duration

Term life insurance policies have a specified duration, while whole life insurance and universal life insurance policies offer coverage for the entire lifetime of the policyholder.

When deciding on the policy duration, consider your financial obligations and the needs of your dependents. If you have young children who will become financially independent in 20 years, a 20-year term life insurance policy may be suitable. On the other hand, if you want lifelong coverage and the ability to build cash value, a whole life insurance or universal life insurance policy may be more appropriate.

Affordability

Life insurance premiums are an ongoing financial commitment, so it's important to choose a policy that is affordable within your budget. Consider your current income, expenses, and financial goals when determining how much you can allocate towards life insurance.

It's worth noting that term life insurance policies generally have lower premiums compared to whole life insurance or universal life insurance. However, premiums for term policies may increase when renewing the policy after the initial term.

When evaluating affordability, it's essential to strike a balance between obtaining adequate coverage and ensuring that the premiums remain manageable throughout the policy duration.

Conversion Options

If you opt for a term life insurance policy, itis important to consider the conversion options available to you. Conversion options allow you to convert your term policy into a permanent policy, such as whole life insurance or universal life insurance, without undergoing a medical exam or providing evidence of insurability. This can be beneficial if you anticipate the need for lifelong coverage in the future.

Financial Strength of the Insurance Company

When selecting a life insurance policy, it is crucial to consider the financial strength and stability of the insurance company. You want to ensure that the company will be able to fulfill its obligations and pay out the death benefit to your beneficiaries when the time comes.

Research the insurance company's ratings from independent rating agencies, such as A.M. Best, Moody's, or Standard & Poor's. These ratings provide insights into the company's financial health and ability to meet its policyholder obligations. Choose a reputable and financially stable insurance company to provide you with peace of mind.

Additional Riders and Benefits

Life insurance policies often offer additional riders and benefits that can enhance the coverage and provide additional protection. Consider your specific needs and preferences to determine which riders may be beneficial for you.

Accelerated Death Benefit Rider

This rider allows you to access a portion of the death benefit if you are diagnosed with a terminal illness, typically with a life expectancy of less than 12 months. The accelerated death benefit can help cover medical expenses or provide financial support during your remaining time.

Waiver of Premium Rider

In the event of a disability that prevents you from working and paying your life insurance premiums, the waiver of premium rider waives future premium payments. This ensures that your coverage remains intact, even if you are unable to pay the premiums due to disability.

Child Term Rider

This rider provides coverage for your children, typically until they reach a certain age, such as 25 or 30. It offers a death benefit in the event of a child's untimely passing, providing financial support during a difficult time.

Spouse Term Rider

If you are married, you may consider adding a spouse term rider to your policy. This rider provides coverage for your spouse, ensuring that their financial needs are protected in the event of their passing.

Guaranteed Insurability Rider

This rider allows you to purchase additional coverage at specific intervals, without undergoing a medical exam or providing evidence of insurability. It can be useful if you anticipate the need for increased coverage in the future, such as after the birth of a child or a significant life event.

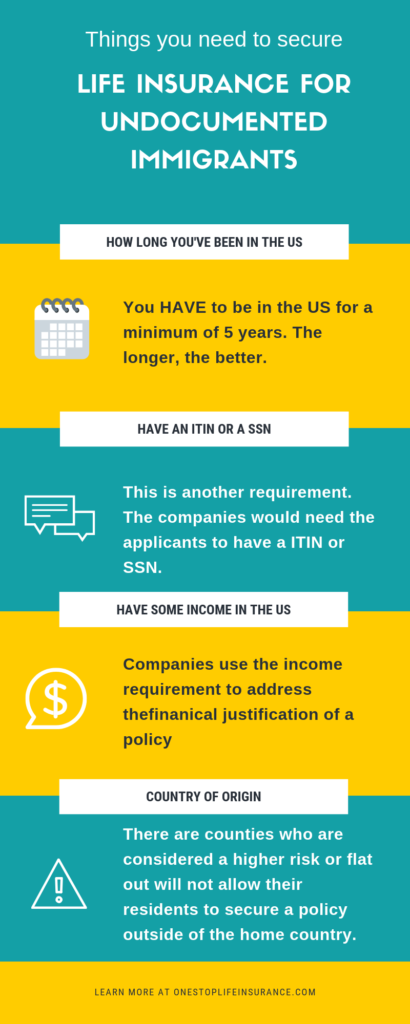

The Role of Immigration Status in Life Insurance

As a new immigrant, your immigration status can impact the process of obtaining life insurance and the terms of the policy. Insurance companies consider factors such as your residency status, visa type, and length of time in the country when assessing your risk profile and determining premiums.

Immigrants who are permanent residents or have obtained citizenship in their new country may have an easier time obtaining life insurance and may be eligible for more favorable terms. These individuals typically have more stability and a longer-term presence in the country, which may result in lower premiums.

On the other hand, new immigrants with temporary visas or uncertain immigration statuses may face more challenges in obtaining life insurance. Insurance companies may view these individuals as higher risk due to the potential for their visa status to change or their return to their home country.

It's important to disclose your immigration status honestly and accurately when applying for life insurance. Failure to do so may result in the denial of your claim in the future. Working with an insurance advisor who specializes in serving the needs of new immigrants can help navigate the complexities of life insurance and find the best options for your specific circumstances.

Building a Strong Life Insurance Application

When applying for life insurance as a new immigrant, there are steps you can take to strengthen your application and increase your chances of approval:

Gather Necessary Documents

Ensure that you have all the necessary documents required for the life insurance application process. These may include identification documents, proof of residency or immigration status, and financial documentation such as tax returns or pay stubs.

Having these documents readily available will streamline the application process and demonstrate your preparedness to the insurance company.

Improve Your Insurability

Insurance companies assess your risk profile when determining your premiums. By taking steps to improve your insurability, you may be able to secure more favorable rates:

Focus on Your Health

Maintaining a healthy lifestyle can positively impact your insurability. Exercise regularly, eat a balanced diet, and avoid habits such as smoking or excessive alcohol consumption. Consider getting regular check-ups and addressing any health concerns proactively.

Establish Credit History

Building a solid credit history in your new country can also contribute to your insurability. Pay your bills on time, maintain low credit card balances, and avoid excessive debt. A positive credit history demonstrates financial responsibility to insurance companies.

Work with an Insurance Advisor

Seeking guidance from an insurance advisor who specializes in serving the needs of new immigrants can be invaluable. They can help navigate the complexities of the application process, provide insights into insurance companies that are more immigrant-friendly, and present you with the best options based on your specific circumstances.

Overcoming Language and Cultural Barriers in Life Insurance

As a new immigrant, you may face language and cultural barriers when understanding and navigating the nuances of life insurance. Here are some practical solutions to overcome these challenges:

Language Assistance

Seek out insurance companies or insurance advisors who can provide language assistance in your native language. This will ensure that you fully understand the terms and conditions of the policy and can make informed decisions.

Translation Services

If language assistance is not readily available, consider utilizing translation services. You can hire a professional translator to help you understand the insurance documents and communicate effectively with insurance company representatives.

Ask for Clarification

If you come across unfamiliar terms or concepts during the application process, don't hesitate to ask for clarification. Request plain language explanations or examples to ensure that you fully grasp the information being presented.

Research and Education

Take the time to educate yourself about life insurance. Research online resources, read articles, and familiarize yourself with the terminology. The more knowledge you have, the better equipped you will be to navigate the process.

Consult with Your Community

Tap into your community resources. Seek advice from fellow immigrants who have gone through the life insurance application process. They may be able to provide insights, recommendations, or share their own experiences to help you better understand and navigate the system.

Life Insurance Riders and Additional Benefits

Life insurance policies often offer additional riders and benefits that can enhance your coverage and provide additional protection. Consider these options to tailor your policy to your specific needs:

Disability Income Rider

This rider provides a supplementary income stream if you become disabled and are unable to work. It ensures that you have a source of income to cover your living expenses and support your family during a period of disability.

Critical Illness Rider

The critical illness rider provides a lump sum payment if you are diagnosed with a specified critical illness, such as cancer, heart attack, or stroke. This payout can help cover medical expenses, treatment costs, or provide financial support during your recovery.

Accidental Death and Dismemberment Rider

This rider provides an additional death benefit if you pass away due to an accident. It may also provide a payout if you suffer the loss of a limb or other specified dismemberment as a result of an accident.

Long-Term Care Rider

The long-term care rider provides coverage for long-term care expenses, such as nursing home care or in-home care, in the event that you require assistance with daily living activities. It helps protect your assets and ensures that you receive the necessary care without depleting your savings.

Importance of Regular Policy Reviews and Updates

Life insurance is not a one-time decision; it requires regular reviews and updates to ensure that it aligns with your changing circumstances and needs. Here are some reasons why regular policy reviews are essential:

Life Events and Changes

Life is full of changes, and your life insurance policy should reflect these changes. Marriage, the birth of a child, purchasing a home, or starting a business are all events that may necessitate a reassessment of your coverage amount or policy type.

Regular policy reviews allow you to adjust your coverage to adequately protect your loved ones and ensure that your policy aligns with your current financial goals.

Policy Performance

Reviewing your policy regularly allows you to evaluate its performance. You can assess whether the policy is meeting your expectations, review the cash value growth (if applicable), and determine if any adjustments need to be made.

Policy reviews also provide an opportunity to compare your existing policy with other options in the market. Insurance products and rates can change over time, so it's important to stay informed and ensure that you have the best policy for yourspecific needs and goals.

Changes in Health or Lifestyle

If your health or lifestyle has changed since you initially purchased your life insurance policy, it's important to review your coverage. Improvements in your health or adoption of healthier habits may make you eligible for lower premiums or better policy options.

Conversely, if you have developed any health conditions or started engaging in high-risk activities, it's crucial to reassess your policy. Some changes in health or lifestyle may require adjustments to your coverage or result in higher premiums.

Changes in Financial Situation

Your financial situation can evolve over time, and your life insurance policy should reflect these changes. If you have experienced significant changes in income, assets, or debts, it's important to review your coverage to ensure that it adequately protects your loved ones and aligns with your current financial goals.

Regular policy reviews allow you to assess whether your coverage amount is still sufficient or if adjustments are needed. It's also an opportunity to evaluate the affordability of your premiums and explore options to make your policy more cost-effective if necessary.

Policy Performance

Reviewing your policy regularly allows you to evaluate its performance. You can assess whether the policy is meeting your expectations, review the cash value growth (if applicable), and determine if any adjustments need to be made.

Policy reviews also provide an opportunity to compare your existing policy with other options in the market. Insurance products and rates can change over time, so it's important to stay informed and ensure that you have the best policy for your specific needs and goals.

Seeking Professional Guidance for Life Insurance

When it comes to navigating the complexities of life insurance as a new immigrant, seeking professional guidance can be invaluable. An insurance advisor who specializes in serving the needs of new immigrants can provide expert advice and help you make informed decisions.

Specialized Knowledge and Experience

An insurance advisor who understands the unique challenges faced by new immigrants can provide valuable insights and guidance. They are familiar with the specific considerations related to immigration status, language barriers, and cultural differences that may impact your life insurance options.

By working with a specialized advisor, you can ensure that you receive personalized recommendations tailored to your specific circumstances and goals.

Access to a Wide Range of Options

An insurance advisor who works with multiple insurance companies has access to a wide range of options. They can help you compare policies, coverage amounts, and premiums from different insurers, ensuring that you find the best fit for your needs.

Additionally, specialized advisors may have access to insurance companies that are more immigrant-friendly or have policies specifically designed for new immigrants. This can increase the likelihood of finding suitable coverage at favorable terms.

Navigating the Application Process

The application process for life insurance can be complex, especially for individuals who are unfamiliar with the system or face language barriers. A specialized insurance advisor can guide you through the application process, ensuring that you provide all the necessary information and documents accurately.

They can also help you understand the terms and conditions of the policy, answer any questions you may have, and advocate on your behalf with the insurance company.

Reviewing and Updating Your Policy

A knowledgeable insurance advisor can provide ongoing support by conducting regular policy reviews and ensuring that your coverage remains suitable as your circumstances change. They can help you assess the need for adjustments, explore new options, and negotiate any changes with the insurance company.

In conclusion, life insurance is a crucial aspect of financial planning for new immigrants. It provides financial protection for you and your loved ones in the face of unforeseen circumstances. By understanding the basics of life insurance, exploring different policy types, considering key factors when choosing a policy, and seeking professional guidance, you can secure the coverage that meets your needs and offers peace of mind in your new home. Regular policy reviews and updates will ensure that your coverage remains aligned with your changing circumstances. Take the necessary steps today to protect your family's financial well-being and embrace your new life with confidence.

Posting Komentar untuk "Life Insurance for New Immigrants: A Comprehensive Guide"